It may be tougher for getting an SBA 504 loan than other sorts of SBA loans. The SBA 504 loan has special program criteria, such as a occupation development/general public policy target necessity. You need to also meet up with all of the standard SBA loan necessities, together with very good credit and powerful revenue.

We can provide lease financing to any government or municipal entity with certain approval. The speed is determined by the rating of your municipality or federal government company. We can easily finance any entity managed federally, by any state or by any local municipality together with Armed companies, General public Colleges, Libraries, Law enforcement and Hearth Departments and more.

To qualify for the most beneficial business loans, lenders will overview specifics about you and your business, including:

A Small Business Administration (SBA) loan can be a business loan that is partly guaranteed from the federal government, but supplied by way of private lenders. This often offers SBA loans lower curiosity prices.

Small business loans can be used to finance growth options for example opening a fresh location, renovating an current space, or obtaining extra inventory or devices.

A benefit of participating in the SBA 504 loan program is that the SBA-backed portion of the financing normally comes with beneath-marketplace curiosity premiums.

Given that we’ve reviewed that instance and the caveats that appear along with the SBA 504 loan program, Allow’s go over the typical options of those loans, starting with loan volume.

Fairness financing includes a threat quality since if a firm goes bankrupt, creditors are repaid in entire just before fairness shareholders acquire anything.

You are increasingly being directed to Nevada Condition Lender’s on the net application portal. If This really is your 1st time browsing this application System, you must arrange a fresh username and password particular to this System by deciding on “Enroll” during the reduce ideal corner from the portal. Remember to DO NOT try to log in with the On line Banking credentials.

Large-scale banks is usually a practical supply for business loans in Las Vegas. A few of some great SBA 504 Business Loan benefits of dealing with these lenders contain:

The us Initial Credit rating Union presents a number of minimal-level and versatile business loans such as business lines of credit score, products loans, plus more to small businesses in Nevada.

Comparing your options is the best way to make sure you’re getting the perfect small business loan for your personal business. Think about the subsequent components when analyzing which loan is best for your needs:

Furthermore, financial debt financing is frequently more affordable (because of a decrease fascination level) since the creditors can claim the firm's assets if it defaults. Interest payments of debts can also be frequently tax-deductible for the organization.

So how exactly does Financial debt Financing Perform? Credit card debt financing happens each time a business raises money for Doing the job funds or money expenditures by offering debt devices to persons and institutional traders.

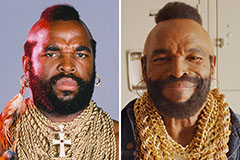

Mr. T Then & Now!

Mr. T Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!